- (049) 548 - 3702

- sambahayanconsumercoop@gmail.com

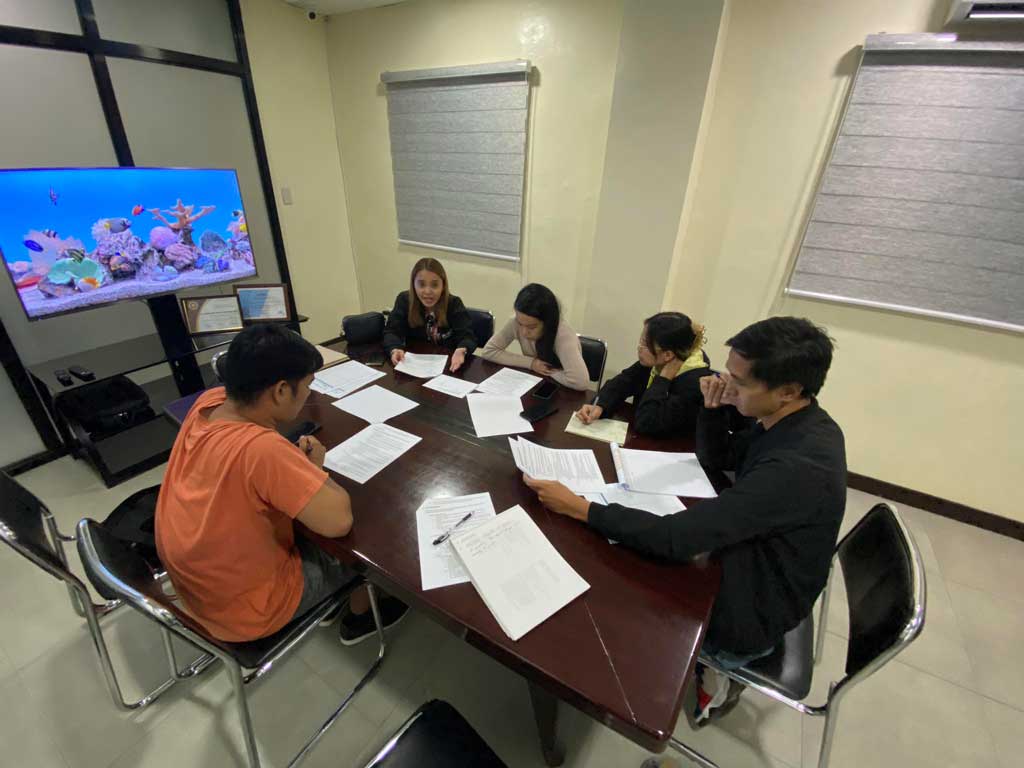

The Accounting, Audit, and IT committees recently held a crucial meeting with the General Manager to address the establishment of a comprehensive cash management policy and accounting procedures for the cooperative’s daily operations. The meeting delved into various topics, covering essential aspects of cash flows within the cooperative.

One of the key areas of discussion was cash receipts, where the committees reviewed and refined the existing processes for accurately recording and documenting all incoming funds. Emphasis was placed on implementing efficient systems to ensure transparency and traceability in cash handling.

The meeting also addressed cash disbursements, focusing on establishing protocols and controls to safeguard against any potential mismanagement or unauthorized transactions. The committees explored methods for streamlining disbursement procedures while maintaining strict accountability and adherence to financial regulations.

Cash controls emerged as another significant point of consideration during the meeting. The committees analyzed internal controls to mitigate the risk of cash losses, theft, or mishandling. Strategies such as segregation of duties, regular audits, and robust reconciliation processes were discussed to bolster the cooperative’s cash control framework.

Inventory management was also a topic of discussion, highlighting the need for accurate tracking and valuation of the cooperative’s assets. The committees emphasized the importance of implementing effective inventory control measures to prevent discrepancies and ensure efficient utilization of resources.

Furthermore, the meeting addressed capital share collection, emphasizing the significance of timely and accurate recording of member contributions. The committees explored ways to enhance the collection process and strengthen documentation to maintain an up-to-date record of capital shares.

Reporting, compliance, and training were identified as critical components of the cash management policy. The committees discussed the creation of standardized reporting formats to provide accurate and timely financial information to stakeholders. Additionally, they highlighted the importance of compliance with relevant financial regulations and discussed training programs to enhance the staff’s understanding of cash management procedures.

It was agreed upon during the meeting that the IT committee would play a vital role in integrating the accounting recording and transaction systems. Recognizing the importance of efficient data management and real-time monitoring, the committee will work towards implementing appropriate software solutions or enhancements to existing systems. This integration will enable seamless tracking and analysis of financial transactions, ensuring accurate and up-to-date records that can be accessed by authorized personnel. By leveraging technology, the cooperative aims to enhance efficiency, reduce manual errors, and facilitate effective financial decision-making processes.

Overall, the meeting between the Accounting, Audit, and IT committees, along with the General Manager, proved instrumental in charting a comprehensive cash management policy and accounting procedures for the cooperative. By addressing various crucial topics, the committees demonstrated their commitment to strengthening financial controls, promoting transparency, and enhancing operational efficiency in the cooperative’s daily cash flows.